Acceptable registrations in the queue through March 30 at 9:00a ET have now been activated. Enjoy! -M.W.

Terms of Use have been amended effective October 6, 2019. Make sure you are aware of the new rules! Please visit this thread for details:

https://www.mibuzzboard.com/phpBB3/view ... 16&t=48619

Debate and discussion of current events and political issues across the U.S. and throughout the World. Be forewarned -- this forum is NOT for the intellectually weak or those of you with thin skins. Don't come crying to me if you become the subject of ridicule. **Board Administrator reserves the right to revoke posting privileges based on my sole discretion**

-

Deleted User 8570

Post

by Deleted User 8570 » Sun Feb 24, 2019 4:06 pm

bmw wrote: ↑Sun Feb 24, 2019 2:16 pm

Straight from NPR:

The reasons for these smaller refunds vary. For most people, it's because each paycheck has grown slightly, thanks to reduced withholding. On balance, they are likely to come out ahead.

Enough said.

Now what should be talked about and never is would be the other end of this... less revenue to the government causing reduced services from the government (including those that may be popular) or exploding deficits because everybody is scared to cut popular stuff out...

This latest round has already blown a hole in the budget...

-

MWmetalhead

- Site Admin

- Posts: 11978

- Joined: Sun Oct 31, 2004 11:23 am

Post

by MWmetalhead » Sun Feb 24, 2019 5:05 pm

I was counting on my usual $1000 back and not $300 or so... so for my money this sucked. I haven’t seen a H*** bump in pay either so I don’t really feel good about all of this stuff...

What was your effective tax rate this year compared to last year?

Looking at refund size alone is foolish, which is the whole point of my OP.

Paul Woods reminds me a bit of the Swedish Chef from the Muppets when he speaks!

-

TC Talks

- Posts: 10249

- Joined: Wed Oct 26, 2005 2:41 am

Post

by TC Talks » Sun Feb 24, 2019 5:15 pm

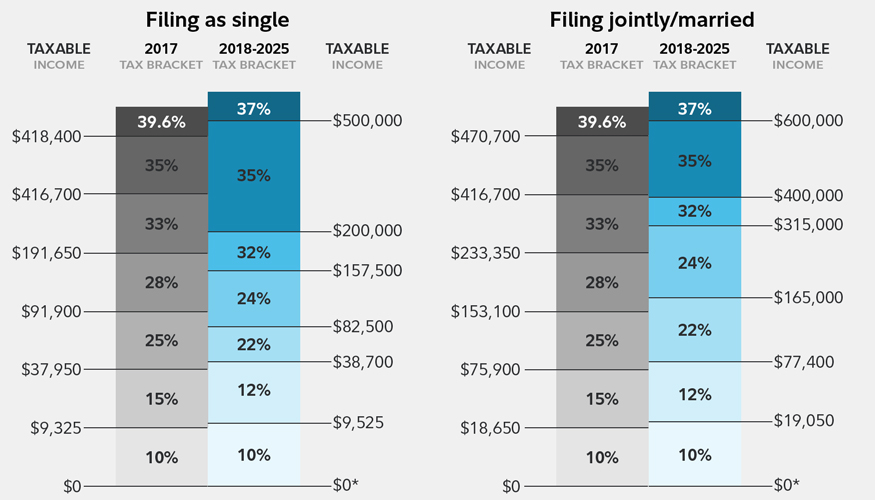

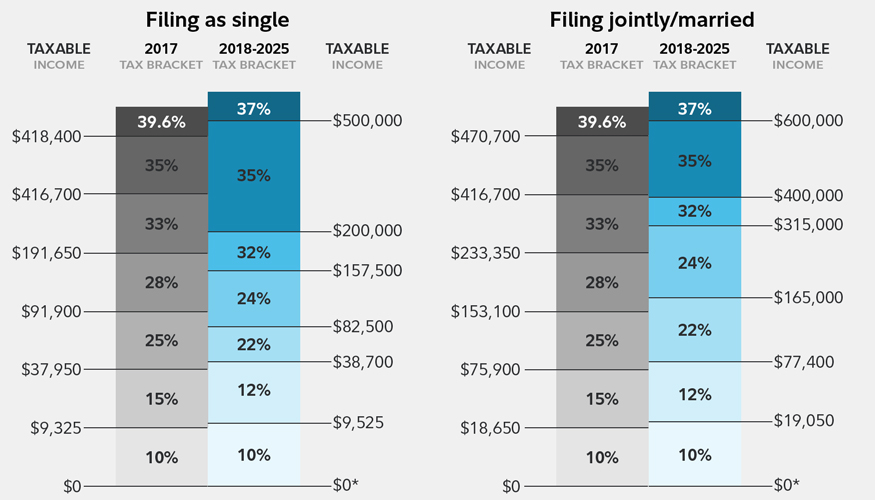

This graph seems to make the most sense... We are all sort of right. But the reduction of deduction thresholds do have an impact.

“The more you can increase fear of drugs, crime, welfare mothers, immigrants and aliens, the more you control all of the people.”

― Noam Chomsky

Posting Content © 2024 TC Talks Holdings LP.

-

Deleted User 8570

Post

by Deleted User 8570 » Sun Feb 24, 2019 5:57 pm

MWmetalhead wrote: ↑Sun Feb 24, 2019 5:05 pm

I was counting on my usual $1000 back and not $300 or so... so for my money this sucked. I haven’t seen a H*** bump in pay either so I don’t really feel good about all of this stuff...

What was your effective tax rate this year compared to last year?

Looking at refund size alone is foolish, which is the whole point of my OP.

Let me know how to come up with it (the math equation) and I’ll get back to you...

-

craig11152

- Posts: 2043

- Joined: Tue Nov 06, 2007 8:15 am

- Location: Ann Arbor

Post

by craig11152 » Mon Feb 25, 2019 8:29 am

If anyone really wants to know where they stand I would simply add up all the dollars the IRS makes you declare as income then find your actual federal tax obligation for that year and divide that by that "gross income" number you added up.

That bypasses all the changes in tax law year to year. It bypasses deductions, credits, exemptions etc.

The number you get is a raw percentage.

Compare it year to year and you know if you are paying a bigger percentage of your "income" or not. Its best to do it over several years to look for a pattern.

I no longer directly engage trolls

-

MWmetalhead

- Site Admin

- Posts: 11978

- Joined: Sun Oct 31, 2004 11:23 am

Post

by MWmetalhead » Mon Feb 25, 2019 5:47 pm

Let me know how to come up with it (the math equation) and I’ll get back to you...

Divide line 15 on Form 1040 (Total Tax) by line 6 (Total Income). This formula is consistent with what Craig described, and it's also the equation I used for purposes of my OP.

This graph seems to make the most sense... We are all sort of right. But the reduction of deduction thresholds do have an impact.

The new tax brackets are certainly more taxpayer friendly than the old brackets, but let's face it - that illustration doesn't present the full picture. It serves as a good baseline for discussion.

Paul Woods reminds me a bit of the Swedish Chef from the Muppets when he speaks!

-

Bryce

- Posts: 7143

- Joined: Thu Jan 03, 2008 12:04 pm

Post

by Bryce » Sat Mar 02, 2019 9:14 am

Lets see how much coverage this gets...

The IRS Now Says People Are Getting Bigger Tax Refunds in 2019. Here’s Why

https://finance.yahoo.com/news/irs-now- ... 38232.htmlNew York and Chicago were all in with respect to their sanctuary status — until they were hit with the challenge of actually providing sanctuary. In other words, typical liberal hypocrisy.